Introductions

Discover how Form 15G and Form 15H can help you claim relief from Tax Deducted at Source (TDS) on interest income earned from listed bonds. Gain insights into eligibility criteria, and submission guidelines, and empower yourself to optimize your savings efficiently

What are Form 15G and Form 15H?

Understanding Form 15G

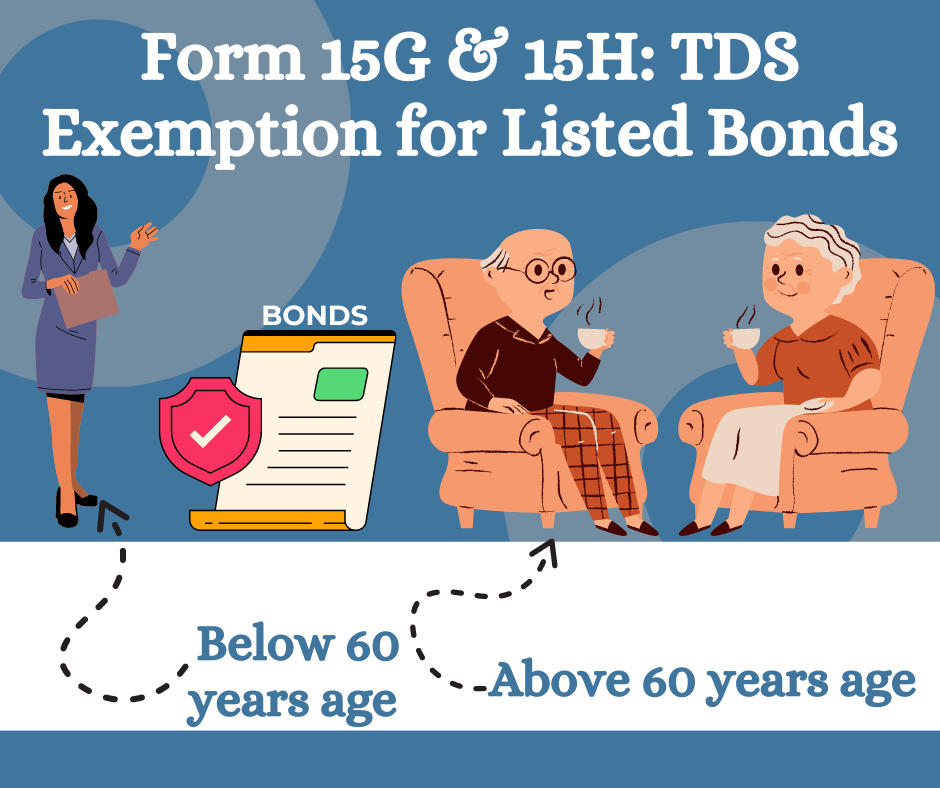

Form 15G, a self-declaration form for individuals below 60 years of age, allows them to declare their income below the taxable limit and request TDS exemption on interest income from listed bonds.

Understanding Form 15H

Form 15H, tailored for individuals aged 60 years or older, enables senior citizens to declare their income below the taxable limit and seek exemption from TDS on interest income from listed bonds.

Eligibility Criteria and Conditions

Who Can Submit Form 15G and Form 15H?

The eligibility criteria for submitting Form 15G and Form 15H, ensuring your total income falls below the prescribed limit to qualify for TDS exemption on listed bond interest income.

Submission Process and Best Practices

Submitting Form 15G and Form 15H

The submission process for Form 15G and Form 15H, including the designated authorities and timelines. Explore best practices for optimizing TDS exemption on interest earnings from listed bonds

Benefits and Considerations

Maximizing Savings with Form 15G and Form 15H

The benefits of Form 15G and Form 15H in minimizing tax liabilities and optimizing savings on interest income from listed bonds. Consider the implications and opportunities for effective tax planning

Conclusion:

Form 15G and Form 15H offer valuable avenues for individuals to claim TDS exemption on interest income from listed bonds. By understanding the eligibility criteria, and submission process, and leveraging these forms effectively, taxpayers can navigate tax obligations and optimize savings intelligently.